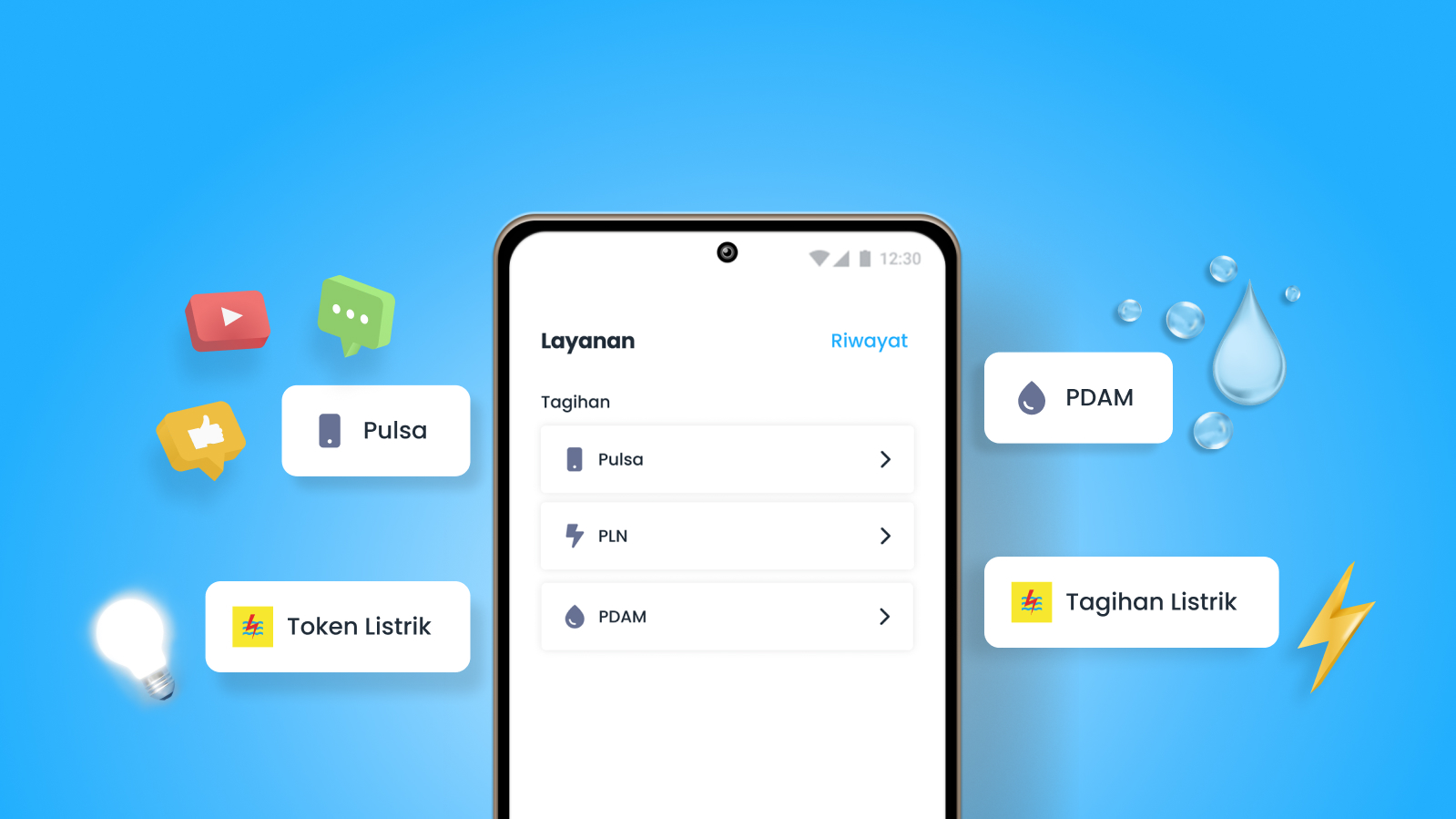

wagely, Asia's leading financial wellness platform, today rolled out a new feature called Bill Payment that makes it easier for users in Indonesia to quickly pay essential bills with their already-earned but unpaid salary without having to go to another payment service. With Bill Payment, employees of wagely partners can top-up PLN electricity tokens and mobile phone balances, as well as pay PDAM water and postpaid electricity bills anywhere and anytime directly from the wagely app.

User-centric innovation is at the core of our mission to improve financial wellness for workers. Since we built our platform, we have constantly innovated and added user-centric features, such as disbursement to e-wallet accounts, Financial Education, and now Bill Payment. As our data show that paying for utility bills is among the top three reasons employees are using wagely, we believe the new feature will greatly benefit our users.

Tobias Fischer, CEO of wagely

For low-to-middle-income workers living paycheck-to-paycheck, having immediate access to their earned salary significantly impacts their lives. It allows workers to control when they get paid and relieve financial burdens that arise from the waiting periods between paydays, which then helps employers have a much more financially healthy workforce. For these workers, it could also mean being able to pay bills on time without having to borrow or hit late fees for missing deadlines, so that they no longer need to worry and can concentrate at work.

Earned wage access from wagely comes with a unique approach toward financial wellness. Employees short on cash before payday no longer need to turn to predatory lenders or inconveniently borrow from other sources as they have access to the app to withdraw a portion of their already-earned salary whenever needed. The newly added feature makes paying essential bills effortless. Employees can simply go to wagely to see how much they have earned and choose which bills they would like to pay.

Our platform stands out for its smooth and effortless experience across all of our services. We prioritize simplicity and usability in the design and development, which our employer partners consistently highlight as a key reason for choosing to do business with us. We are proud to offer a product that their employees can depend on and that has gained a reputation for its quality and reliability.

Tobias Fischer, CEO of wagely

Bank Indonesia recorded that the value of electronic money transactions grew 35.79% (YoY) in the third quarter of 2022, partly due to the development and convenience of digital payment systems. Rapid advances in the digital economy, further accelerated by COVID-19, are changing the financial services landscape and creating opportunities to drive further inclusion and impact. The launch of the new Bill Payment feature is also in line with wagely’s commitment to supporting financial inclusion in Indonesia.

Accordingly, wagely was recently named among the global winners of the 2022 Inclusive Fintech 50 for its work toward supporting the financial inclusion of low-to-middle-income workers in Indonesia and Bangladesh. Managed by the Center for Financial Inclusion, the Inclusive Fintech 50 is an annual global initiative that competitively selects 50 early-stage fintech companies with innovative business models, in which wagely was one of only two companies from Indonesia on the winner lineup.